|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding VA Streamline Interest Rates Today: A Comprehensive GuideFor veterans and active-duty service members, the VA Streamline Refinance, also known as the Interest Rate Reduction Refinance Loan (IRRRL), offers an excellent opportunity to refinance an existing VA loan. Understanding today's VA streamline interest rates is crucial for making informed financial decisions. What is a VA Streamline Refinance?The VA Streamline Refinance is designed to simplify the refinancing process for veterans and service members. It allows borrowers to refinance their existing VA loan into a new VA loan with a lower interest rate. Benefits of VA Streamline Refinance

Current VA Streamline Interest RatesToday's VA streamline interest rates are influenced by several factors, including market conditions and lender policies. It's essential to compare rates from different lenders to ensure you get the best deal. For those exploring other refinancing options, you might consider checking out the 10 year mortgage refi rates for a broader perspective on the market. Factors Affecting VA Streamline Rates

Steps to Obtain a VA Streamline RefinanceTo proceed with a VA Streamline Refinance, follow these steps:

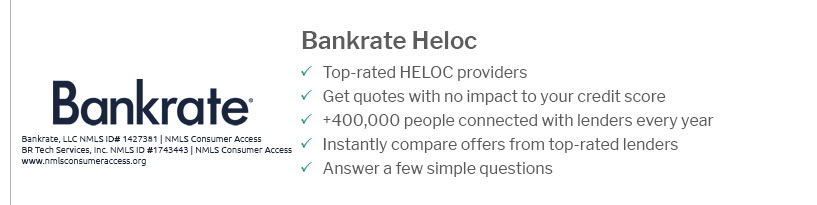

For those interested in other lending options, consider exploring the best heloc lenders in california for diverse financial solutions. Frequently Asked QuestionsWhat is the minimum credit score required for a VA Streamline Refinance?The VA does not set a minimum credit score for the IRRRL, but lenders typically require a score of at least 620. Can I receive cash back with a VA Streamline Refinance?No, the VA Streamline Refinance does not allow cash-out. It is intended solely for reducing the interest rate on an existing VA loan. How long does the VA Streamline Refinance process take?The process can take anywhere from 30 to 45 days, depending on the lender and individual circumstances. Staying informed about current VA streamline interest rates can significantly impact your financial planning and savings. By understanding the nuances of VA streamline refinancing, veterans and service members can make the most of this beneficial program. https://www.zillow.com/mortgage-rates/va-refinance-rates/

The current average 30-year fixed VA refinance rate climbed 7 basis points from 6.34% to 6.41% on Tuesday, Zillow announced. The 30-year fixed VA refinance rate ... https://www.veteransunited.com/refinance/streamline/

Current VA IRRRL Rates ; 30-Year Streamline (IRRRL) Refinance, 5.990%, 6.291%, 1.7500 ($5162.50) ; 30-Year Streamline (IRRRL) Jumbo Refinance, 6.500%, 6.680% ... https://www.usaa.com/inet/wc/bank-real-estate-va-irrrl

VA IRRRL rates. 6.000 % interestSee note2; 6.119% APRAnnual Percentage RateSee note3. You can include all costs in a VA IRRRL and we'll cover your title and ...

|

|---|